Optimising MySQL for your Finance company

Contents

- FinTech pushing Innovation

- Financial Services and FinTech companies utilising MySQL

- Open Source helping the Financial Services industry to Innovate

- The FinTech Ecosystem

- Technology and Requirements

- Security and Regulatory Compliance

- MySQL Security Architecture

- MySQL Heatwave - Larry Ellison

- MySQL Use Case: WePay

- Conclusion

FinTech pushing Innovation

FinTech companies are combining modern, agile technologies with a data-driven approach to meet the evolving needs of consumers. Market Data Forecast expects the global FinTech market to reach US$324 billion by 2026, growing at a compound annual growth rate (CAGR) of 23.41%. Check out our FinTech IT support and services.

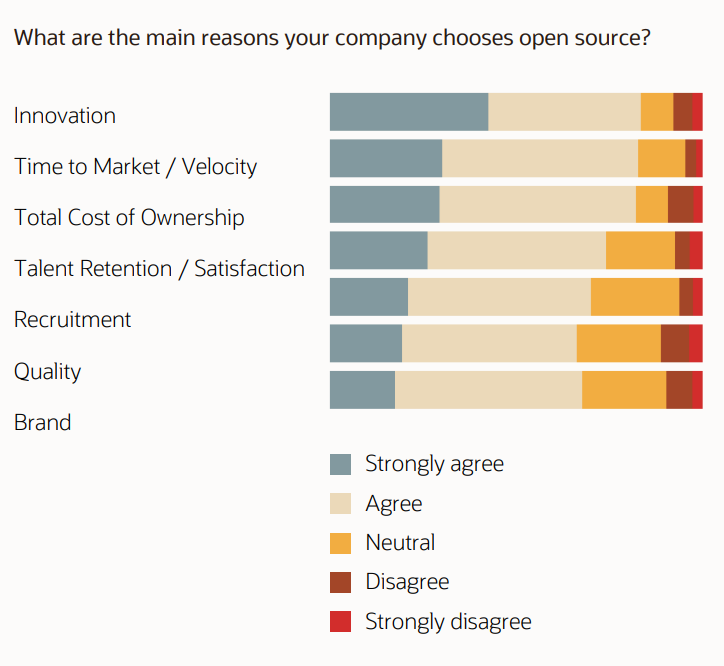

Open Source helping Financial Services to Innovate

Open source software is the driving force behind the modernisation of the financial services sector. The 3 key reasons for adopting open source software are innovation, time to market and the total cost of ownership (TCO) savings. Other reasons include high-quality software, optimum security, access to the latest innovations, and cloud capabilities.

FINOS is an organisation that helps financial institutions actively adopt open source software to tackle the long-standing technology and business challenges in the financial technology space.

In the FINOS 2021 State of Open Source in Financial Services report, innovation was the number one reason for choosing open source software

The FinTech Ecosystem

FinTech companies typically specialise in one product or service. They focus on inclusivity with mobile-first initiatives and ease of use. They use modern technology such as open source, cloud-native, and microservices to develop and iterate solutions faster.

The FinTech ecosystem counts many innovative applications in a broad range of financial segments, from digital payment, neobanks, digital financing and loans, money transfers, peer-to-peer payments, and alternative lending to robo investment advisors, blockchain, and cryptocurrencies.

Digital Payments

Consumers continue aggressively adopting digital payment technologies for online and mobile purchases and person-to-person (P2P) payments. In the US, more than 75% of people use some form of digital payment.

Small and medium-sized businesses (SMBs) increase revenue using digital payment providers as an end-to-end solution for managing all payment needs - including online orders, point-of-sales (POS) systems, auto-billing, payroll, and financing.

Neobanks

Neobanks are challenging the traditional banking model with low-cost structures, feature-rich products and services as well as easy accessibility.

According to Insider Intelligence, there will be 47.5 million digital-only bank account holders in the United States by 2024.

Loans and Financing

Buy-Now-Pay-Later (BNPL) is an alternative to credit cards that allows consumers to pay after purchase at no added cost. BNPL firms act as a financial lender of instalment loans for consumers to use at the point of sale to finance a purchase.

Consumers will make nearly US$100 billion in retail purchases using BNPL programs in 2021 - up from US$24 billion in 2020 and US$20 billion in 2019.

Money Transfers

According to the World Bank, global transfers cost over 6% of the amount sent. FinTech global remittance providers have significantly lower remittance costs, allowing consumers to make transfers 24x7 from any device and realise transfers instantaneously.

Peer-to-Peer Payments

Peer-to-peer (P2P) platforms are becoming the preferred way for consumers to make payments as it provides them with the convenience of sending money from a mobile device.

Banks are responding to this trend by partnering with FinTech companies to provide their P2P payment capabilities.

Alternative Lending

Many consumers and businesses have difficulty getting a financial loan through a traditional bank due to their incomplete credit history.

Alternative lending FinTech companies are using artificial intelligence, machine learning, and big data to solve this longstanding issue of the lending market. In 2020, the global alternative lending market’s transaction volume reached US$291.4 billion.

Robo Investment Advisors

Robo advisors provide automated investment advice, a breakthrough in the formerly exclusive wealth management market, bringing advice services to a broader audience with lower costs than traditional human advice.

In 2008, the first robo investment advisors were launched. In 2020, the money managed by robo advisors hit US$2 trillion.

Blockchain and Cryptocurrencies

Blockchain and cryptocurrencies are becoming commercially viable technologies in banking applications. JP Morgan has built a separate platform named Onyx and uses its digital token, JPM Coin, to send cross-border payments to clients.

Microservices and Kubernetes

Microservices allow development teams to build cloud-native applications faster using smaller sets of services, giving organisations added agility.

MySQL Operator for Kubernetes makes managing microservices much more straightforward by simplifying development operations and application workload portability.

Performance

As digital payment volumes are skyrocketing, FinTech companies must process high volumes of transactions in real time and perform at scale.

Databases are at the core of this activity. With each new release, MySQL delivers significant performance improvements and sets new benchmark records to help grow the finance industry.

Real-Time Analytics

Fraud detection has been a significant concern in the financial services industry. Datasets continue to grow larger, making it much more challenging to detect fraud on time.

Real-time analytics solutions such as MySQL HeatWave help organisations identify suspicious or fraudulent activity immediately, preventing losses while meeting regulatory requirements.

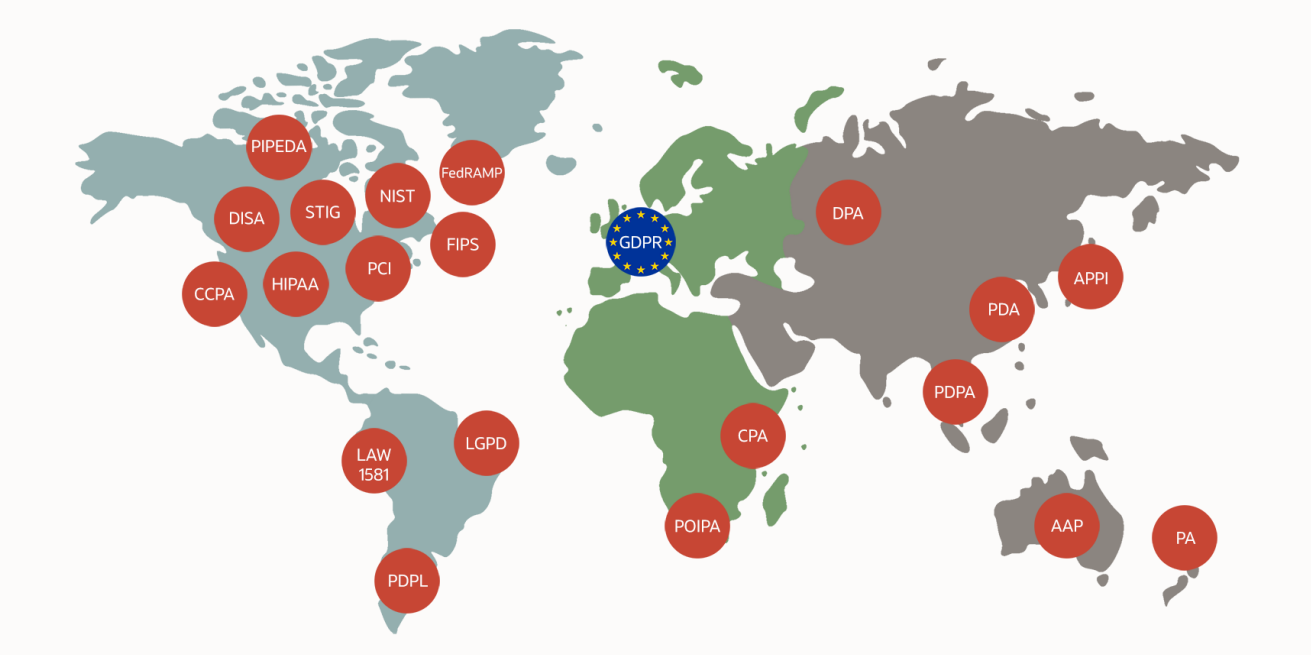

Security and Regulatory Compliance

To protect individuals and consumers, over 100 countries have now adopted data protection laws. For example, General Data Protection Regulation (GDPR) is a wide-ranging data protection regulatory scheme that covers data privacy and data security.

Financial organisations face their own set of requirements, such as PCI, which requires businesses to handle credit card information securely to reduce the likelihood that cardholders would have sensitive financial account information stolen.

MySQL Enterprise Edition

MySQL Enterprise Edition provides the essential technologies to protect sensitive data following industry regulations such as Payment Card Industry (PCI) compliance.

It also reduces the risk, cost, and complexity of developing, deploying, and managing critical MySQL applications.

Assess

- MySQL Enterprise Monitor

Prevent

- MySQL Enterprise Authentification

- MySQL Enterprise Firewall

- MySQL Enterprise Encryption

- MySQL Enterprise Data Masking

Detect

- MySQL Enterprise Audit

Recover

- MySQL Enterprise HA

- MySQL Enterprise Backup

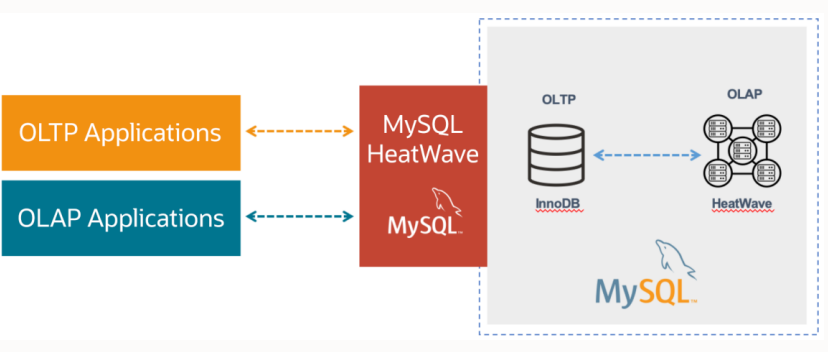

MySQL HeatWave in the Cloud

MySQL HeatWave is the only service that enables customers to run online transaction processing (OLTP) and online analytical processing (OLAP) workloads directly from their MySQL database.

It eliminates the need for complex, time-consuming, and expensive data movement and integration with a separate analytics database.

-

Single MySQL database for OLTP and OLAP

-

No need to ETL

-

Query real-time data

-

Applications work without any changes

-

Scales to thousands of cores

-

5400x faster than Amazon RDS

-

1400x faster that Amazon Aurora

-

6.5x faster that Redshift

"Independent analysts have tested and confirmed that MySQL HeatWave runs 10 to 100 times faster than Amazon’s version of MySQL called Aurora. This technological breakthrough is causing several of Amazon's customers to start moving their Aurora workloads to Oracle MySQL. And industry analysts are telling us they are seeing a 10x increase in Oracle Cloud Infrastructure customer inquiries. Both the Oracle Autonomous Database and Oracle MySQL with HeatWave technology have captured the technology high ground in the cloud database business and that bodes well for the future of the Oracle Cloud.”

Larry Ellison

Chariman, CTO | Oracle

Application

WePay is the integrated payment system of JP Morgan Chase. WePay provides a highly available, reliable, and secure online payment infrastructure to ensure small businesses get paid quickly and easily.

Business Benefit

- Improved database availability and scalability

- Deeper observability of changes in the production database to quickly evolve the payment platform

- Satisfied regulatory compliance through policy-based auditing, identity management, and encryption tools

Why MySQL Enterprise Edition?

“We are going through a period of huge terabyte growth which is why MySQL Enterprise’s high availability is key to our uptime and has become the most reliable part of our infrastructure.” – Rich Steenburg, Senior Director of Engineering, WePay

Conclusion

The financial services and FinTech industry are modernising and transforming with cloud, microservices, open source, and MySQL. Companies that thrive will be those that adopt a data-first approach to give customers better insights into their financial health.

Many FinTech and financial services companies use MySQL today to gain a clear competitive advantage. They are using MySQL Enterprise Edition on-premises and MySQL HeatWave in Oracle Cloud for increased performance, regulatory compliance, and significant cost savings.

MySQL HeatWave is 5400x faster than Amazon RDS, 1400x faster than Amazon Aurora, and 6.5x faster than Redshift - at half the cost.

If you're interested in bespoke FinTech support and services, why not find out more - FinTech IT support and services

You might also be interested in...

MySQL HeatWave: One MySQL Database service for OLTP, OLAP, and ML

MySQL HeatWave offers the world's most popular open-source database on Oracle Cloud, AWS, and Azure for a fraction of the price of other cloud providers.

Unlock the value in data with Oracle’s Modern Data Warehouse

This page explores the significance of data in various industries, its impact on the future of organisations, and the top data challenges that companies face today.

Want to explore how MySQL can benefit your organisation?

Get in touch with our specialists today and start your MySQL journey with industry experts.

.png?width=250&height=56&name=stonewater-logo%20(1).png)

.svg)